All Categories

Featured

Table of Contents

In spite of being certified, all capitalists still require to execute their due diligence during the process of investing. Accredited financiers can access our option of vetted investment possibilities.

With over $1.1 billion in safeties marketed, the administration team at 1031 Crowdfunding has experience with a large range of investment structures. To access our full offerings, register for a capitalist account.

Accredited's workplace culture has actually typically been Our company believe in leaning in to sustain boosting the lives of our coworkers in the exact same way we ask each other to lean in to passionately sustain enhancing the lives of our customers and area. We provide by using methods for our group to rest and re-energize.

Proven Accredited Investment Platforms Near Me

We likewise use up to Our magnificently assigned building consists of a health and fitness room, Rest & Leisure areas, and innovation made to sustain flexible offices. Our finest concepts originate from working together with each various other, whether in the office or functioning remotely. Our positive investments in innovation have actually enabled us to create an allowing team to add anywhere they are.

If you have an interest and feel you would certainly be an excellent fit, we would enjoy to link. Please inquire at.

Quality Secure Investments For Accredited Investors (Oakland CA)

Certified capitalists (in some cases called certified capitalists) have accessibility to investments that aren't available to the general public. These financial investments could be hedge funds, tough money finances, convertible investments, or any various other safety that isn't signed up with the financial authorities. In this write-up, we're mosting likely to focus particularly on actual estate financial investment alternatives for accredited capitalists.

This is every little thing you need to understand about realty spending for approved financiers (secure investments for accredited investors). While anybody can invest in well-regulated safeties like stocks, bonds, treasury notes, shared funds, etc, the SEC is worried concerning ordinary capitalists entering financial investments beyond their methods or understanding. So, instead of allowing anybody to invest in anything, the SEC produced a recognized investor criterion.

It's important to keep in mind that SEC laws for recognized capitalists are designed to safeguard investors. Without oversight from financial regulators, the SEC merely can't assess the threat and benefit of these financial investments, so they can't give info to educate the ordinary investor.

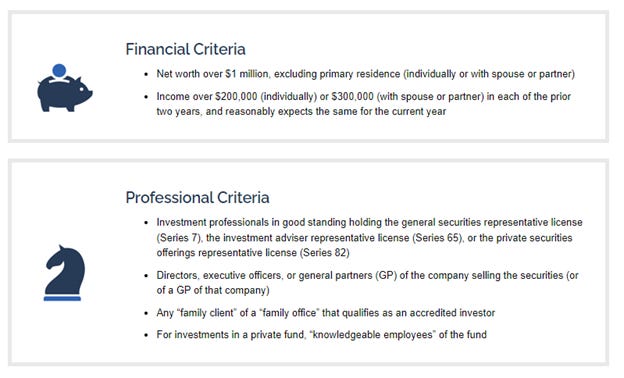

The idea is that capitalists who make enough income or have adequate wealth are able to soak up the danger much better than investors with reduced income or less wealth. As a recognized investor, you are expected to finish your very own due diligence prior to adding any kind of asset to your investment profile. As long as you fulfill among the complying with four requirements, you qualify as an approved financier: You have actually earned $200,000 or more in gross earnings as an individual, yearly, for the past 2 years.

Leading Crowdfunding Sites For Accredited Investors Near Me

You and your spouse have actually had a combined gross earnings of $300,000 or more, each year, for the previous two years. And you anticipate this degree of earnings to proceed. You have a net well worth of $1 million or even more, excluding the worth of your primary home. This indicates that all your possessions minus all your debts (leaving out the home you live in) overall over $1 million.

Or all equity owners in the company qualify as certified financiers. Being a certified financier opens doors to investment opportunities that you can not access or else. When you're certified, you have the option to spend in unregulated protections, which includes some impressive investment opportunities in the realty market. There is a large range of realty investing approaches available to financiers who don't currently meet the SEC's needs for accreditation.

Dependable Private Placements For Accredited Investors Near Me – Oakland

Ending up being an approved investor is merely an issue of verifying that you satisfy the SEC's demands. To verify your revenue, you can provide documentation like: Tax return for the past two years, Pay stubs for the previous 2 years, or W2s for the past 2 years. To verify your net worth, you can give your account statements for all your properties and obligations, consisting of: Savings and inspecting accounts, Financial investment accounts, Outstanding financings, And genuine estate holdings.

You can have your attorney or CPA draft a verification letter, validating that they have actually reviewed your financials which you meet the demands for a certified financier. It might be more cost-effective to make use of a solution particularly created to verify accredited capitalist statuses, such as EarlyIQ or .

Best Alternative Investments For Accredited Investors – Oakland

If you sign up with the actual estate investment firm, Gatsby Investment, your accredited financier application will certainly be refined via VerifyInvestor.com at no charge to you. The terms angel capitalists, advanced investors, and certified capitalists are frequently made use of mutually, but there are refined distinctions. Angel financiers offer seed cash for startups and little services in exchange for ownership equity in the business.

Usually, any person who is certified is assumed to be a sophisticated financier. Individuals and service entities who keep high earnings or significant riches are assumed to have practical knowledge of finance, certifying as sophisticated. tax-advantaged investments for accredited investors. Yes, global investors can end up being recognized by American financial criteria. The income/net worth requirements stay the exact same for foreign investors.

Here are the best financial investment chances for accredited investors in realty. is when capitalists pool their funds to buy or refurbish a property, after that share in the earnings. Crowdfunding has ended up being one of the most popular techniques of spending in real estate online because the JOBS Act of 2012 permitted crowdfunding systems to supply shares of property projects to the public.

Some crowdfunded property financial investments do not need certification, but the projects with the best potential rewards are typically scheduled for accredited investors. The distinction between tasks that accept non-accredited financiers and those that only accept accredited financiers normally boils down to the minimal investment amount. The SEC presently limits non-accredited capitalists, who earn less than $107,000 per year) to $2,200 (or 5% of your yearly income or web well worth, whichever is less, if that amount is even more than $2,200) of financial investment resources annually.

Latest Posts

Tax Lien Investment

2021 Delinquent Real Property Tax Auction

What Does Tax Lien Investing Mean